Robert Rubin once said: “Some people are more certain of everything than I am of anything.”It’s a reminder that in investing, the only certainty is uncertainty.

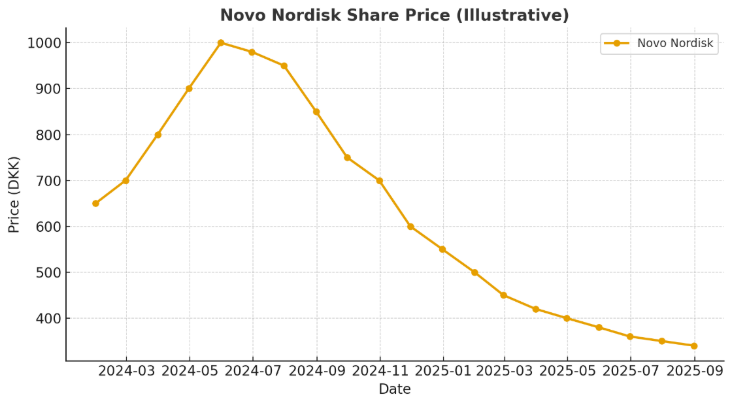

Two recent stories underline this. First, Novo Nordisk lost a fifth of its value in a single day after lowering its 2025 profit forecast. The company is still set to grow – just not at the sky-high levels investors had assumed. The result? Shares fell two-thirds from their peak, punishing anyone who believed growth would continue in a straight line.

Chart 1: Novo Nordisk’s sharp share price fall shows how quickly lofty forecasts can unravel.

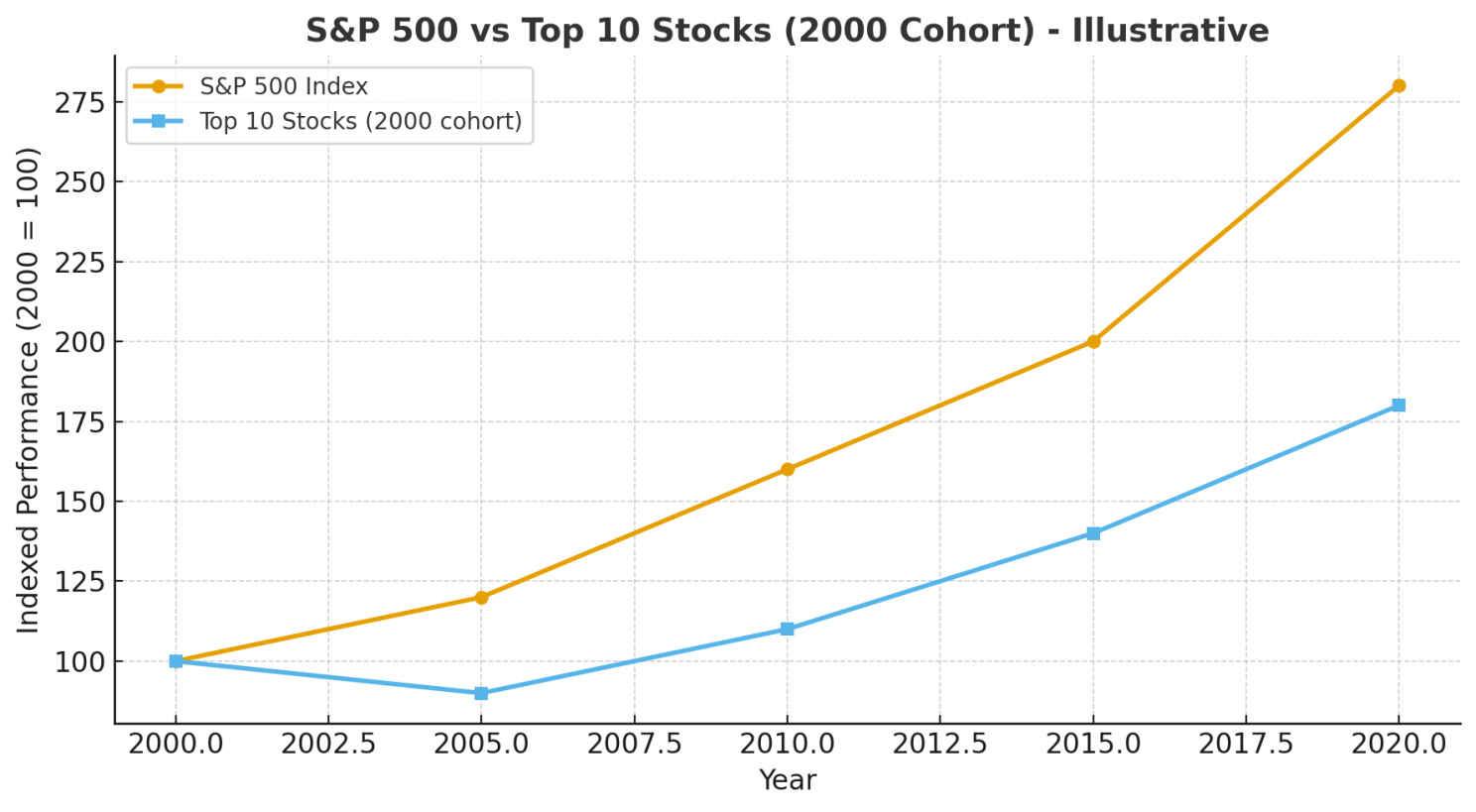

Second, Deutsche Bank data shows only two of the ten largest companies in 2000 have outperformed the S&P 500 since then. Some now earn less than they did 24 years ago. Today’s “Magnificent Seven” may look unstoppable, but history suggests otherwise. Forecasts built on confidence often crumble under reality.

Chart 2: The top 10 stocks of 2000 underperformed the S&P 500 over the following two decades, a warning for todays market favourites.

So what does this have to do with bonds? Everything.

Bonds aren’t equities – and that’s the point

It’s tempting to apply the same logic to bonds that we use with equities: buy the index, avoid active managers, keep costs low. But fixed income is different.

- The Bloomberg Global Aggregate Index tracks over 31,000 securities across 72 countries.

- By comparison, the FTSE All-World Index covers around 4,200 equities.

Bond markets are vast, fragmented, and constantly evolving as new issues replace old ones. Companies issue one class of shares, but often dozens of bonds, each with different maturities, coupons, and structures.

That complexity creates inefficiencies – and inefficiencies create opportunity.

📖 For context, see the FCA’s overview of fixed income products and risks.

Why active fixed income still matters

In equities, active managers often struggle to beat the benchmark after fees. In bonds, the story can be different.

Active managers can:

- Unearth overlooked bonds that rarely trade but offer attractive risk-adjusted returns.

- Tilt towards improving economies, where sovereign yields are falling.

- Select issuers with strengthening fundamentals, where credit spreads may tighten.

They don’t need to forecast the future perfectly. They just need to use flexibility to reduce exposure where risk is rising, and increase exposure where markets misprice resilience.

Managing risk when forecasts fail

For clients, the bigger benefit isn’t just potential alpha – it’s risk management.

When expectations break down in equities, valuations can collapse overnight (as Novo Nordisk showed). In fixed income, active managers can adjust portfolios dynamically to smooth returns, protect capital, and keep portfolios aligned with client goals.

That agility supports:

- Capital preservation for clients worried about volatility.

- Income stability when yields are attractive but uneven.

- Outcome alignment, a key requirement under the FCA’s Consumer Duty PS22/9.

Passive vs. active – not either/or

None of this means passive bond funds don’t have a place. They remain a low-cost way to gain broad exposure. But framing the choice as “all passive” or “all active” is misleading.

The sweet spot may be benchmark-aware strategies: active funds that keep costs in check while using their flexibility to manage risk and exploit inefficiencies. Vanguard’s Global Core and Global Strategic Bond Funds are examples, designed either as standalone allocations or complements to index exposure.

What advisers and paraplanners should take away

For advisers, the key message for clients is simple: forecasts will fail. What matters is whether portfolios can flex when they do.

For paraplanners, this means documenting the rationale clearly:

- Diversification beyond the benchmark

- Risk management as well as return

- Alignment with client objectives, not just performance targets

That alignment is what makes suitability defensible – and what helps clients stay invested when forecasts inevitably disappoint.

The bottom line

Forecasting may be fragile, but strategy doesn’t have to be. Equity markets will always lure investors with stories of endless growth. History suggests those stories often end badly.

Bond markets, by contrast, offer scope to use complexity and inefficiency as tools for stability. Active fixed income isn’t about outguessing the market. It’s about building portfolios that remain resilient when the forecasts go wrong.

And if the last few months have shown us anything, it’s that forecasts willgo wrong.

👉 If this resonates with what you’re seeing in client conversations, we’d love to hear from you.